Streamlining Financial Operations: Bank Reconciliation Automation Software for Businesses

Posted on 25 October, 2023 by Kosh.ai

In today's fast-paced business environment, managing financial transactions efficiently is a top priority for organizations. Bank reconciliation, the process of matching a company's financial records with those of its bank, plays a crucial role in this endeavour. While traditionally a manual and time-consuming task, businesses are increasingly turning to bank reconciliation automation software to streamline and enhance this essential financial process. In this article, we'll explore the benefits and features of Bank Reconciliation Automation Software for Business and how it can improve financial operations for businesses.

The Challenge of Manual Bank Reconciliation

Before delving into the advantages of automation, it's essential to understand the challenges associated with manual bank reconciliation:

- Time-Consuming: Manually reconciling financial records with those of the bank can be a time-consuming task, especially for businesses with high transaction volumes.

- Error-Prone: Human errors are inevitable when dealing with a large number of transactions, which can lead to discrepancies and financial inaccuracies.

- Delayed Reporting: Manual reconciliation can cause delays in generating financial reports, hindering real-time decision-making.

- Resource-Intensive: It requires skilled personnel to perform manual reconciliations, which can be costly and inefficient.

- Lack of Scalability: As businesses grow, the volume of transactions increases, making manual reconciliation even more challenging.

The Advantages of Bank Reconciliation Automation Software

Bank reconciliation automation software offers a comprehensive solution to the challenges of manual reconciliation. Here are the key benefits:

- Time Efficiency: Automation significantly reduces the time required for reconciliation. It can process a high volume of transactions quickly, providing real-time insights into the company's financial position.

- Accuracy: Automated reconciliation software minimizes human errors, ensuring that financial records match those of the bank accurately.

- Real-Time Reporting: With automation, businesses can access up-to-date financial information, enabling quicker decision-making and improving financial transparency.

- Resource Optimization: Automation reduces the need for dedicated personnel to perform reconciliation tasks, allowing them to focus on more strategic activities.

- Scalability: As a business grows, the software can easily adapt to handle increased transaction volumes without a significant increase in costs.

Key Features of Bank Reconciliation Automation Software

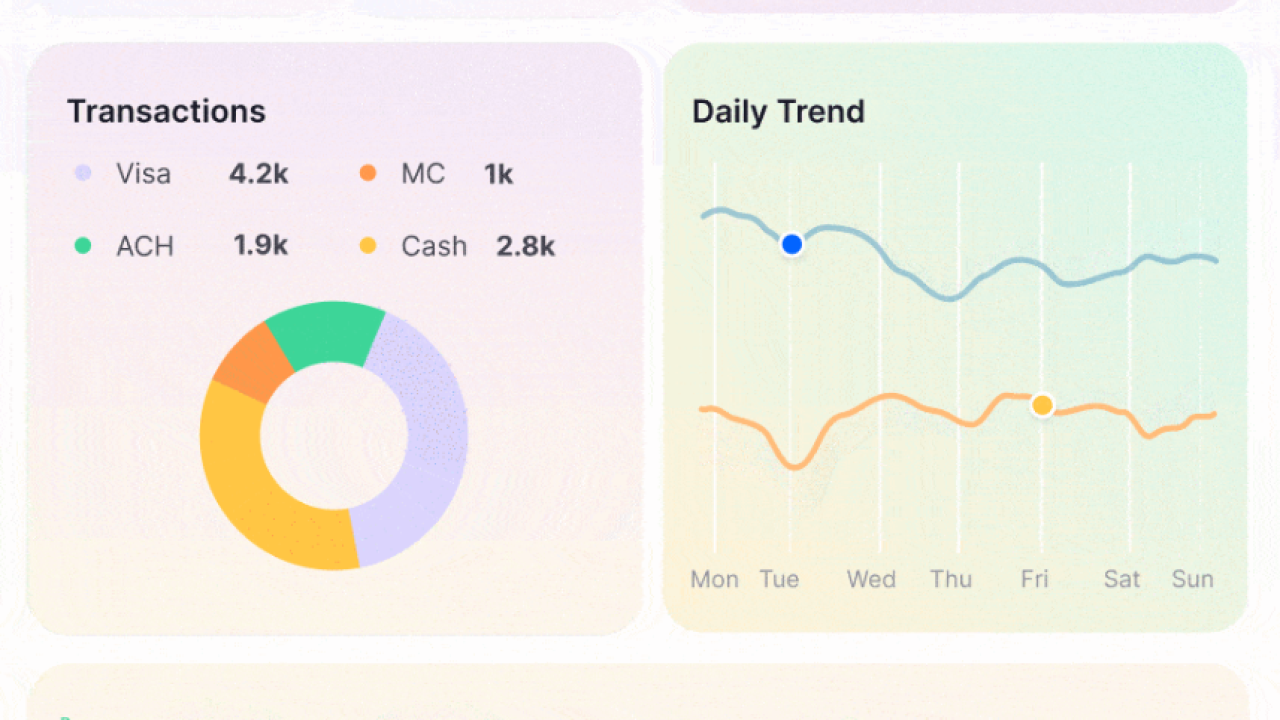

- Transaction Matching: The software matches and compares a company's financial transactions with those recorded by the bank, identifying discrepancies and anomalies.

- Data Import: It can seamlessly import data from various sources, such as accounting software, spreadsheets, and bank statements.

- Rules-Based Matching: Users can define rules and criteria for transaction matching, improving accuracy and efficiency.

- Automated Reporting: The software generates detailed reconciliation reports, offering insights into financial discrepancies and trends.

- Audit Trails: It maintains a detailed record of all reconciliation activities, providing a clear audit trail for financial compliance.

- Exception Handling: Automation software identifies and highlights exceptions or discrepancies, allowing for immediate investigation and resolution.

- Bank Statement Import: It can directly import electronic bank statements, further streamlining the reconciliation process.

Case in Point: The Benefits of Bank Reconciliation Automation

Consider a medium-sized e-commerce company that experiences a high volume of daily transactions. Without automation, their finance team would need to dedicate substantial time and resources to manually reconcile transactions across various payment gateways, credit card processors, and their bank accounts. Errors and discrepancies would likely occur, leading to delays in financial reporting and decision-making.

By implementing bank reconciliation automation software, this e-commerce company can:

- Dramatically reduce the time required for reconciliation, allowing for real-time insights into their financial position.

- Minimize errors and discrepancies, improving financial accuracy and transparency.

- Free up finance personnel to focus on strategic financial planning and analysis.

- Seamlessly handle an increase in transaction volumes as the company expands.

Bank reconciliation is a critical financial process for any business, and automating it offers numerous advantages, including time efficiency, accuracy, real-time reporting, resource optimization, and scalability. Bank reconciliation automation software provides a comprehensive solution to the challenges associated with manual reconciliation, making it an invaluable tool for streamlining financial operations.

As businesses continue to seek ways to improve efficiency, transparency, and accuracy in their financial processes, bank reconciliation automation software is becoming an essential component of their financial toolkit. It empowers organizations to manage their financial transactions with ease, ensuring that they maintain a clear and accurate view of their financial health in real time.

For more details, visit us :

Automated Bank Reconciliation Software

Integrated Treasury Management System

Tools to Automate Finance Processes