Bank Reconciliation Automation: Streamlining Financial Management

Posted on 25 May, 2024 by Kosh.ai

Bank reconciliation automation involves the use of software and technology to streamline the process of matching a company's financial records with its bank statements. This automation significantly reduces the time and effort required for reconciliation, enhances accuracy, and provides greater financial control. Here’s an in-depth look at the benefits, features, and considerations of bank reconciliation automation.

Benefits of Bank Reconciliation Automation

Efficiency and Time Savings: Bank Reconciliation Automation process eliminates the need for manual matching of transactions, which can be time-consuming and labor-intensive. This allows finance teams to focus on more strategic tasks and improves overall productivity.

Improved Accuracy: By automating data matching and transaction verification, the risk of human error is minimized. This leads to more accurate financial records and helps prevent discrepancies that could result in financial misstatements or compliance issues.

Real-Time Processing: Automated systems often provide real-time or near-real-time reconciliation. This ensures that financial data is always current, allowing businesses to quickly identify and address discrepancies as they occur.

Enhanced Security: Bank reconciliation automation software often includes advanced security features such as data encryption, access controls, and audit trails. These measures help protect sensitive financial information and ensure compliance with regulatory standards.

Better Financial Control: Automated reconciliation provides a clear and accurate view of financial transactions, enhancing financial oversight and control. This improved transparency helps businesses maintain accurate records and make informed financial decisions.

Key Features of Bank Reconciliation Automation

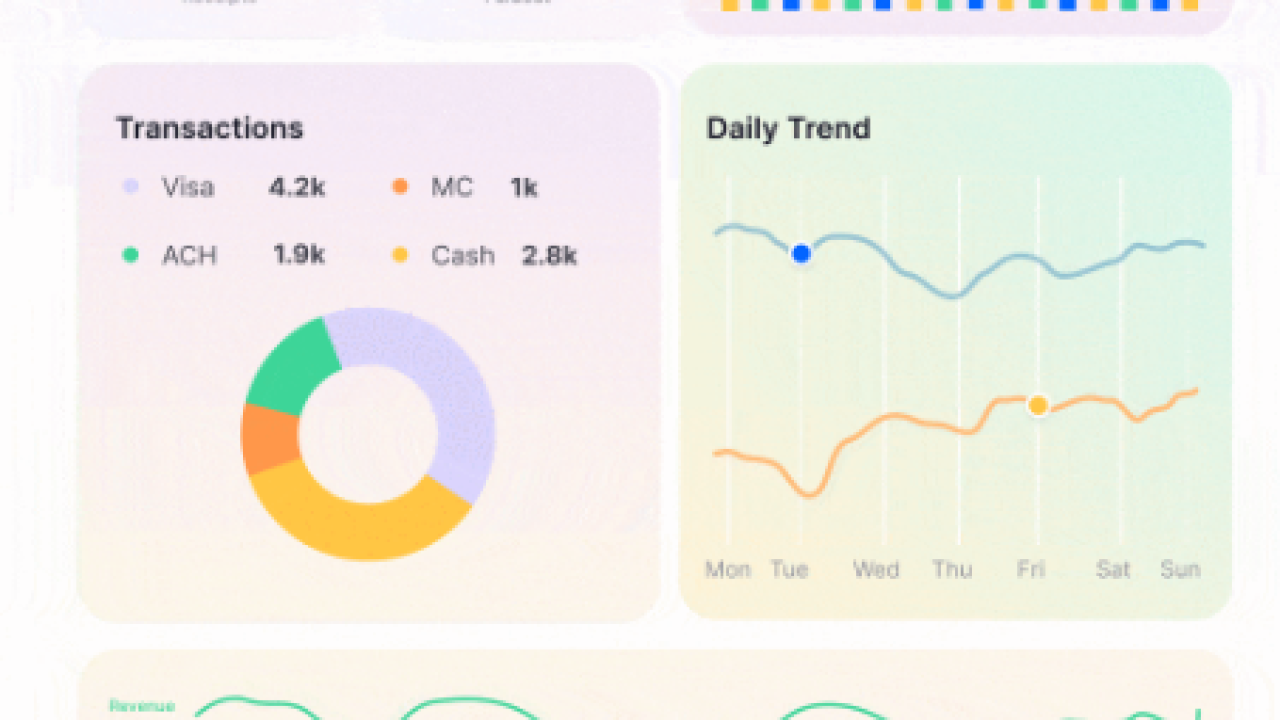

Automated Transaction Matching: The core feature of bank reconciliation automation is its ability to automatically match transactions from bank statements with the company’s financial records based on criteria such as date, amount, and transaction type.

Customizable Rules and Filters: Users can define custom rules and filters to tailor the reconciliation process to their specific needs. This includes setting up criteria for automatic matching, flagging exceptions, and handling recurring transactions.

Exception Handling and Alerts: Automated systems can identify discrepancies and unmatched transactions, flagging them for review. Alerts and notifications can be configured to inform users of any issues that require attention.

Integration with Financial Systems: These solutions typically integrate seamlessly with existing accounting and ERP systems. This ensures smooth data flow and reduces the need for manual data entry, enhancing overall efficiency.

Detailed Reporting and Analytics: Advanced reporting and analytics features provide insights into the reconciliation process. Users can generate reports on reconciliation status, exceptions, and historical trends to support decision-making and compliance.

Considerations When Choosing Bank Reconciliation Automation

Scalability: Ensure the software can scale with your business as it grows. It should handle increasing transaction volumes without compromising performance or accuracy.

Ease of Use: Look for a user-friendly interface that simplifies the reconciliation process. The system should be intuitive and require minimal training for finance staff to use effectively.

Integration Capabilities: Verify that the software can integrate with your existing financial systems. Seamless integration is crucial for maintaining data consistency and streamlining workflows.

Customization Options: Choose a solution that offers customization options to fit your specific reconciliation needs. The ability to set up custom rules, filters, and workflows can enhance the system’s effectiveness.

Customer Support and Training: Consider the level of customer support and training provided by the vendor. Reliable support and comprehensive training resources can help ensure successful implementation and ongoing use of the software.

Conclusion

Bank reconciliation automation is an essential tool for modern finance teams looking to enhance efficiency, accuracy, and control over their financial processes. By automating the reconciliation of financial records with bank statements, businesses can save time, reduce errors, and gain real-time insights into their financial health. When selecting a system, consider factors such as scalability, ease of use, integration capabilities, customization options, and the quality of customer support. Implementing the right bank reconciliation automation solution can streamline financial management and enable businesses to focus on more strategic financial activities.

For more info. visit us:

Beyond Balance Sheets: How Cash Visibility Impacts Financial Statements