Ditch the Manual: Embrace Bank Reconciliation Automation

Posted on 18 May, 2024 by Kosh.ai

Bank reconciliation – the process of ensuring your accounting records match your bank statements – is a crucial but often time-consuming task. But what if you could automate the slog and free up your team for more strategic work? Bank Reconciliation Automation (BRA) is here to revolutionize your financial operations.

What is Bank Reconciliation Automation?

Bank Reconciliation Automation leverages software to automate the bank reconciliation process. It streamlines tasks like:

Securely Downloading Bank Statements: BRA eliminates manual data entry by automatically fetching your bank statements.

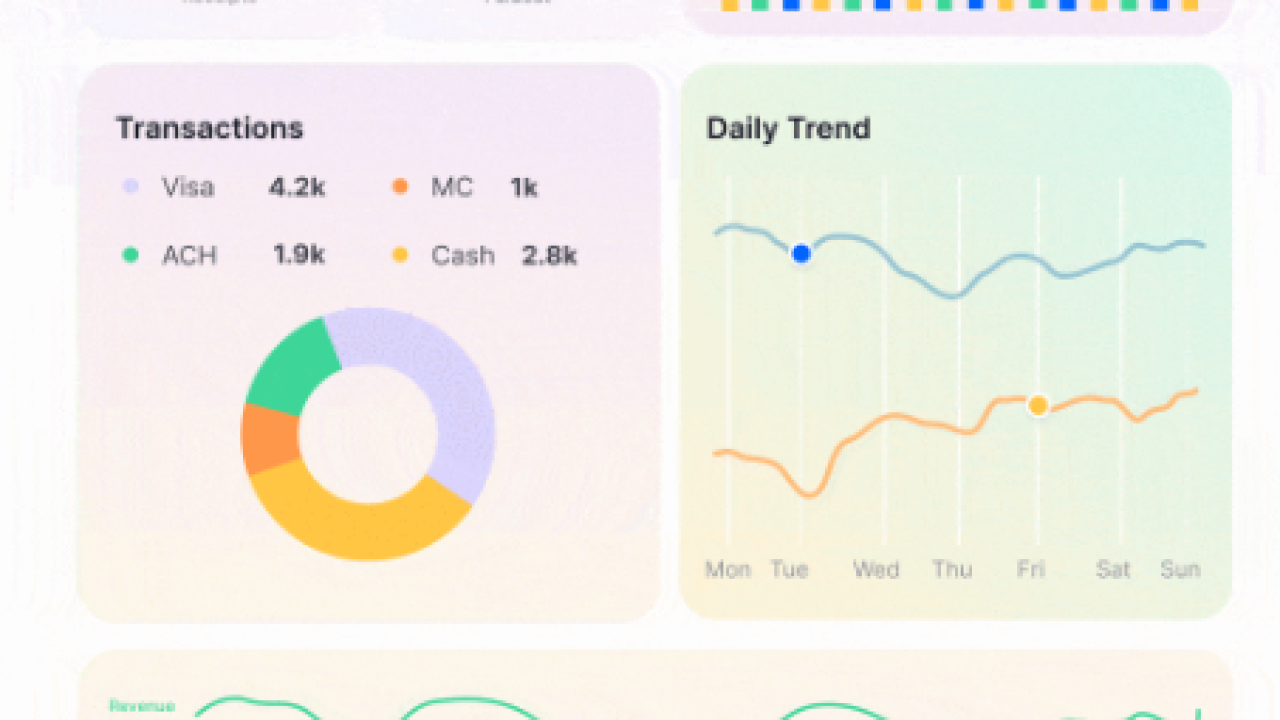

Intelligent Transaction Matching: Advanced algorithms automatically match transactions between your accounting system and bank statements, saving you hours of manual comparison.

Exception Highlighting: Discrepancies or unmatched transactions are flagged for review, allowing you to focus on potential errors or missing information.

Reconciliation Reporting: BRA generates reports that summarize the reconciliation process and highlight any outstanding issues.

Benefits of Bank Reconciliation Automation:

Enhanced Efficiency: Automating repetitive tasks frees your team from manual reconciliation, allowing them to focus on higher-value analysis and strategic financial planning.

Improved Accuracy: BRA minimizes human error in data entry and matching, leading to more reliable and trustworthy financial records.

Faster Close Cycles: Streamlined reconciliation reduces processing time, allowing you to close your financial books faster and meet deadlines with ease.

Reduced Costs: BRA saves on labor costs associated with manual reconciliation and minimizes processing errors that could lead to financial penalties.

Real-Time Visibility: Up-to-date reconciled data provides a clear and accurate picture of your financial health, enabling data-driven decision-making.

Fraud Detection: BRA can identify anomalies during the matching process, potentially uncovering fraudulent activity before it impacts your finances.

Implementing Bank Reconciliation Automation:

Here are some key considerations when implementing BRA:

Integration: Ensure the software seamlessly integrates with your existing accounting system for a smooth workflow.

Security: Choose a provider with robust security features to protect your sensitive financial data.

Customization: Look for BRA solutions that allow you to configure matching rules based on your specific business needs and transaction types.

Scalability: Select a system that can grow with your business and accommodate increasing transaction volumes.

Investing in the Future

Bank Reconciliation Automation is more than just a time-saving tool; it's an investment in your financial future. By automating manual tasks, BRA empowers your team to focus on strategic initiatives while ensuring the accuracy and integrity of your financial data. Embrace BRA, and watch your financial operations soar to new heights of efficiency and accuracy.

For more info. visit us:

The role of CFOs in driving digital transformation in finance