Streamlining Financial Operations: Bank Reconciliation Automation

Posted on 16 March, 2024 by Kosh.ai

Bank reconciliation is a crucial process for businesses to ensure the accuracy of their financial records by comparing their internal accounting transactions with the ones reported by their bank. Traditionally, this process has been manual and time-consuming, involving matching individual transactions and identifying discrepancies. However, with the advancement of technology, Bank Reconciliation Automation has become a game-changer, offering significant time savings, improved accuracy, and enhanced efficiency. Let's explore what Bank Reconciliation Automation entails, its benefits, and how it can revolutionize financial operations for businesses.

What is Bank Reconciliation Automation?

Bank Reconciliation Automation is the process of using software and technology to automate and streamline the reconciliation of financial transactions between a company's accounting records and its bank statements. This automation eliminates the need for manual entry and matching of transactions, reducing errors and saving valuable time for finance teams. By leveraging advanced algorithms and integration with banking systems, Bank Reconciliation Automation ensures that transactions are reconciled accurately and efficiently.

Key Benefits of Bank Reconciliation Automation

Time Efficiency: Automation significantly reduces the time required for reconciliation tasks. What might have taken hours or days manually can now be completed in minutes, freeing up finance teams for more strategic activities.

Accuracy and Error Reduction: Automation minimizes the risk of human error associated with manual reconciliation. Transactions are matched and verified with precision, reducing discrepancies and improving data integrity.

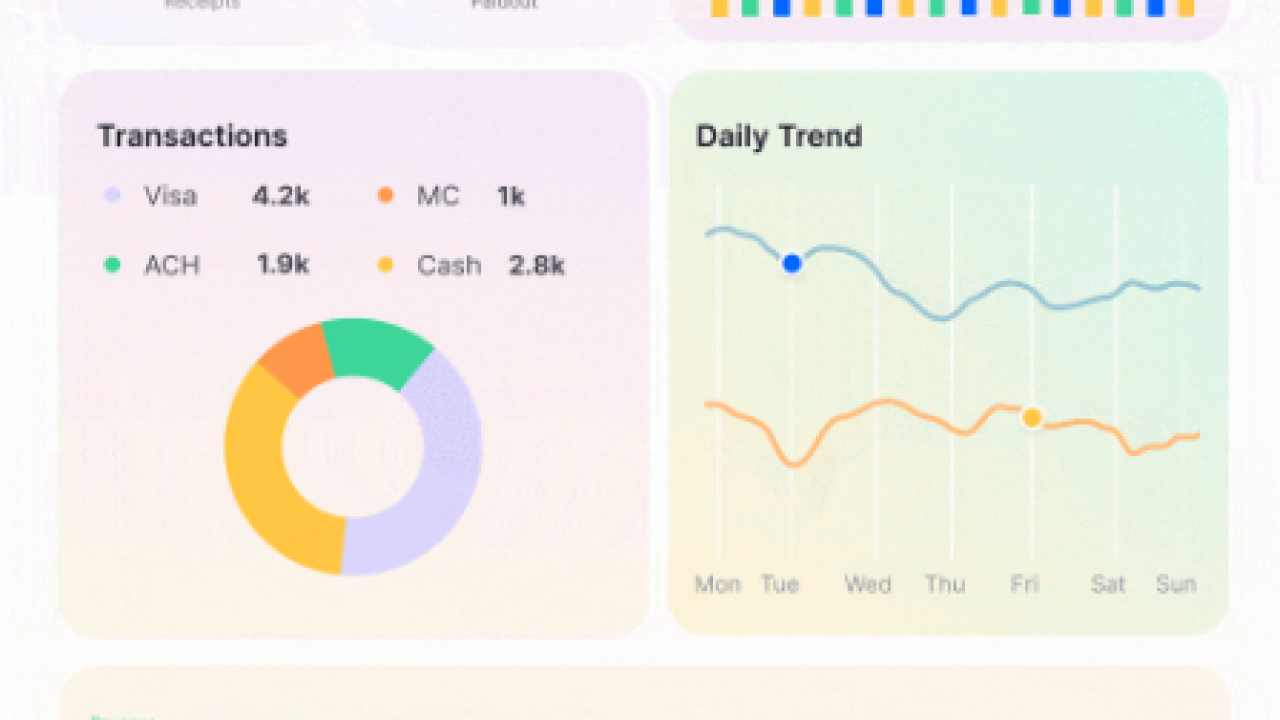

Real-time Reconciliation: With Bank Reconciliation Automation, businesses can perform reconciliations more frequently, even daily if needed. This provides real-time insights into cash flow, outstanding transactions, and financial health.

Enhanced Visibility: Bank Reconciliation Automation provides a clear and comprehensive view of financial data. Businesses can quickly identify discrepancies, exceptions, and trends, enabling better decision-making.

Cost Savings: By reducing manual effort, Bank Reconciliation Automation lowers operational costs associated with reconciliation processes. It allows organizations to allocate resources more efficiently.

Improved Compliance: Automation helps maintain compliance with accounting standards and regulatory requirements. It ensures that transactions are accurately recorded and reported.

How Bank Reconciliation Automation Works

Data Import: Automated systems import data from multiple sources including bank statements, accounting systems, and spreadsheets.

Matching Algorithms: Advanced algorithms match transactions automatically based on predefined rules and criteria such as amounts, dates, and references.

Reconciliation Process: The system reconciles matched transactions, identifies discrepancies, and flags them for further review.

Exception Handling: Any unmatched transactions or discrepancies are highlighted as exceptions, which require manual intervention by finance teams.

Reporting: Bank Reconciliation Automation generates detailed reports summarizing the reconciliation process, outstanding items, exceptions, and reconciliation status.

Automated Posting: Once reconciliations are approved, the system can automatically update the company's accounting records, general ledger, and financial statements.

Top Bank Reconciliation Automation Software Solutions

1. Xero

Bank Feeds: Offers automated bank feeds for real-time transaction matching.

Bank Rules: Customizable rules for automatic categorization and reconciliation.

Integration: Integrates with a wide range of banks and financial institutions.

User-Friendly: Intuitive interface for easy reconciliation workflows.

2. QuickBooks Online

Bank Reconciliation: Automates bank reconciliation with bank feeds and matching algorithms.

Transaction Matching: Matches transactions with bank statements for accuracy.

Report Generation: Generates reconciliation reports for auditing and analysis.

Multi-Currency Support: Handles reconciliation for businesses dealing with multiple currencies.

3. Sage Intacct

Automation: Streamlines bank reconciliation with automated processes.

Integration: Integrates seamlessly with banks and financial systems for data import.

Real-time Updates: Provides real-time updates on reconciliation status and discrepancies.

Scalability: Suitable for businesses of all sizes with varying reconciliation needs.

4. FreshBooks

Bank Feeds: Automatically imports transactions from connected bank accounts.

Expense Tracking: Matches expenses with bank transactions for reconciliation.

Automation Rules: Customizable rules for automating categorization and matching.

Real-time Insights: Provides real-time visibility into cash flow and financial health.

Conclusion

Bank Reconciliation Automation is a powerful tool that can significantly improve the efficiency, accuracy, and visibility of financial operations for businesses. With benefits such as time efficiency, accuracy, enhanced visibility, cost savings, and improved compliance, automation has become a necessity in today's fast-paced business environment. Top software solutions like Xero, QuickBooks Online, Sage Intacct, and FreshBooks offer comprehensive features for automated bank reconciliation, transaction matching, exception handling, and reporting.

Businesses should consider their specific needs, transaction volumes, and integration requirements when choosing a Bank Reconciliation Automation solution. By embracing automation, businesses can streamline their reconciliation processes, reduce errors, and gain real-time insights into their financial health. Bank Reconciliation Automation is not just about saving time and effort—it's about empowering finance teams to make informed decisions and drive business growth.

For more info.visit us:

The Role of Technology in Modernizing Intercompany Reconciliation and Financial Statements

https://www.omniya.co.uk/

5 September, 2020

https://www.irresistiblevapehouse.co.nz/

7 February, 2020

http://theglobalassociates.com

28 September, 2020