Urban Money: Your Gateway to Financial Empowerment

Posted on 23 February, 2024 by Urban Money

Urban Money is more than just a financial platform—it's a comprehensive resource designed to empower individuals with the knowledge, tools, and confidence to achieve their financial goals in today's urban landscape. Whether you're looking to save for the future, invest wisely, or navigate the complexities of urban finances, Urban Money is here to guide you. Here's why Urban Money is your go-to resource for financial empowerment:

1. Financial Education for Urban Living:

Urban Money provides tailored financial education for the unique challenges and opportunities of urban living.

From budgeting in high-cost urban areas to navigating city-specific financial resources, Urban Money equips you with the knowledge to thrive.

2. Budgeting Tools and Resources:

Gain access to intuitive budgeting tools and resources to help you manage your finances effectively.

Urban Money offers budgeting templates, expense trackers, and tips for optimizing your urban lifestyle without breaking the bank.

3. Investment Guidance:

Ready to invest in your future? Urban Money offers insights and guidance on urban-friendly investment strategies.

Learn about real estate investing in urban areas, stocks, ETFs, and other investment opportunities tailored to city living.

4. Smart Saving Strategies:

Saving money in urban environments can be challenging, but Urban Money provides smart saving strategies.

Discover tips for finding affordable housing, reducing transportation costs, and maximizing urban discounts and deals.

5. Urban Entrepreneurship:

Urban Money celebrates urban entrepreneurship and provides resources for aspiring business owners.

Learn about starting a business in the city, accessing funding, and navigating the urban business landscape.

6. Financial Wellness Tips:

Urban Money prioritizes your financial wellness with expert tips and advice.

Explore articles and guides on managing debt, building credit, and achieving financial stability in urban settings.

7. Real-Life Urban Money Stories:

Connect with real people sharing their urban money journeys and success stories.

Gain inspiration and learn from others who have overcome financial challenges and achieved their goals in the city.

8. Urban Lifestyle and Finance Blog:

Stay informed and entertained with Urban Money's blog, covering topics at the intersection of urban lifestyle and finance.

Discover articles on urban travel hacks, city living on a budget, and financial success stories from urbanites like you.

9. Community and Support:

Join the Urban Money community to connect with like-minded individuals on a financial empowerment journey.

Share tips, ask questions, and find support as you navigate your urban financial landscape.

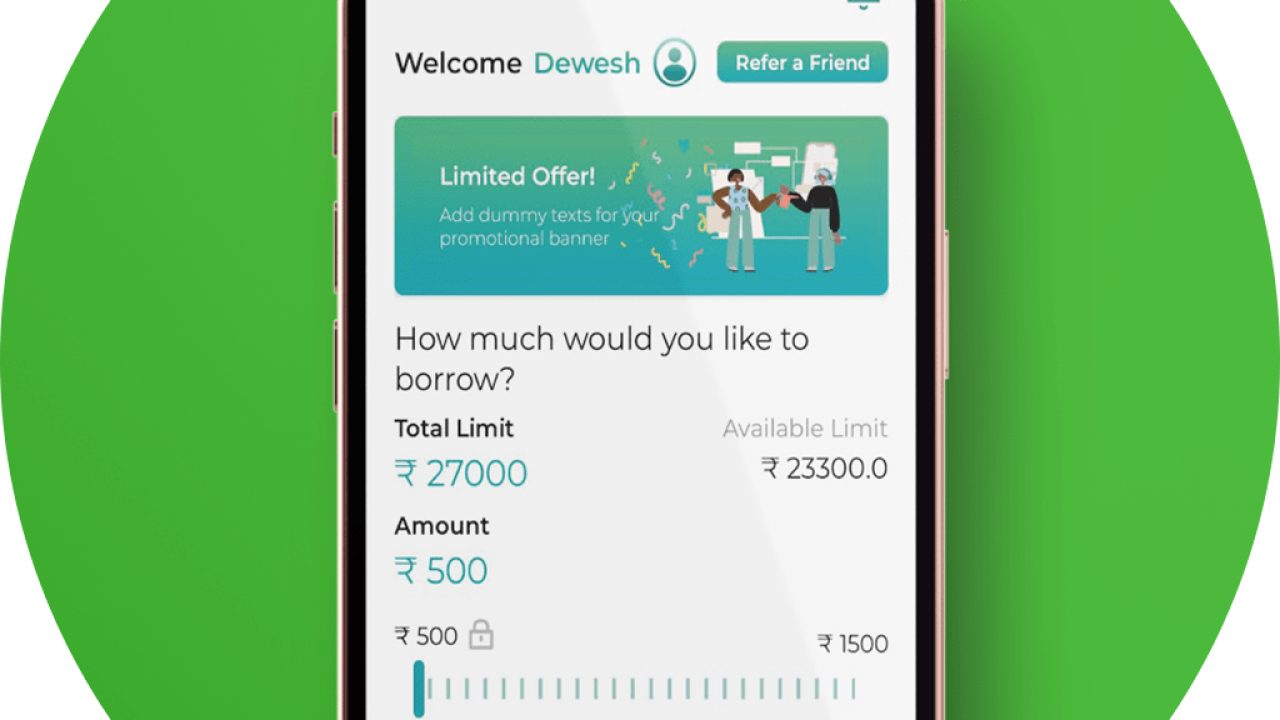

10. Urban Money Mobile App:

Take Urban Money with you wherever you go with the mobile app, putting financial tools and resources at your fingertips.

Easily track your expenses, set financial goals, and access educational content on the go.

In Conclusion: Urban Money is your trusted partner in navigating the financial landscape of urban living. Whether you're a city dweller looking to save, invest, or start a business, Urban Money provides the resources and guidance you need to succeed. From budgeting tools and investment insights to real-life stories and expert advice, Urban Money is your one-stop destination for financial empowerment in the city. Join the Urban Money community today and take control of your urban finances for a brighter, more secure future.

For more info. visit us:

https://www.abhijitpaul.com

15 January, 2019