"Rationalization Finances: The Power of an Automated Reconciliation System"

Posted on 23 December, 2023 by Kosh.ai

In the dynamic landscape of finance, accuracy and efficiency are paramount. The advent of technology has ushered in transformative solutions, and one such game-changer is the Automated Reconciliation System. This article explores the significance of Automated Reconciliation System, shedding light on their benefits, functionality, and the profound impact they have on optimizing financial processes.

1. The Evolution of Financial Reconciliation:

Traditionally, financial reconciliation involved manual, time-consuming processes that left room for errors. The Automated Reconciliation System represents a paradigm shift, leveraging technology to streamline and enhance the accuracy of financial reconciliation. This evolution aligns with the growing need for efficiency and precision in today's fast-paced financial landscape.

2. Real-Time Accuracy and Precision:

One of the key advantages of an Automated Reconciliation System is its ability to provide real-time accuracy and precision. By automating the matching of financial transactions, discrepancies and errors can be identified promptly, allowing financial teams to address issues swiftly and maintain a more accurate and up-to-date financial picture.

3. Enhanced Efficiency and Time Savings:

Automation brings unparalleled efficiency to the reconciliation process. Tasks that once required hours or days of manual effort can now be completed in a fraction of the time. This not only frees up valuable resources but also allows financial professionals to focus on higher-value activities, such as strategic planning and analysis.

4. Seamless Integration with Multiple Platforms:

Modern businesses often operate across diverse platforms and financial systems. An Automated Reconciliation System excels in its ability to seamlessly integrate with various platforms, centralizing data and ensuring consistency across systems. This adaptability is crucial for organizations with complex financial structures and multiple accounts.

5. Minimizing Human Error and Improving Compliance:

Human error is an inherent risk in manual reconciliation processes. Automated systems significantly reduce the likelihood of errors by applying predefined rules consistently. This not only enhances accuracy but also contributes to improved compliance with regulatory requirements, a critical aspect in today's stringent financial environments.

6. Customizable Rule-Based Matching:

The flexibility of Automated Reconciliation Systems lies in their customizable, rule-based matching capabilities. Financial teams can define specific criteria and rules for matching transactions, tailoring the system to the unique needs of the organization. This adaptability ensures that the reconciliation process aligns precisely with business requirements.

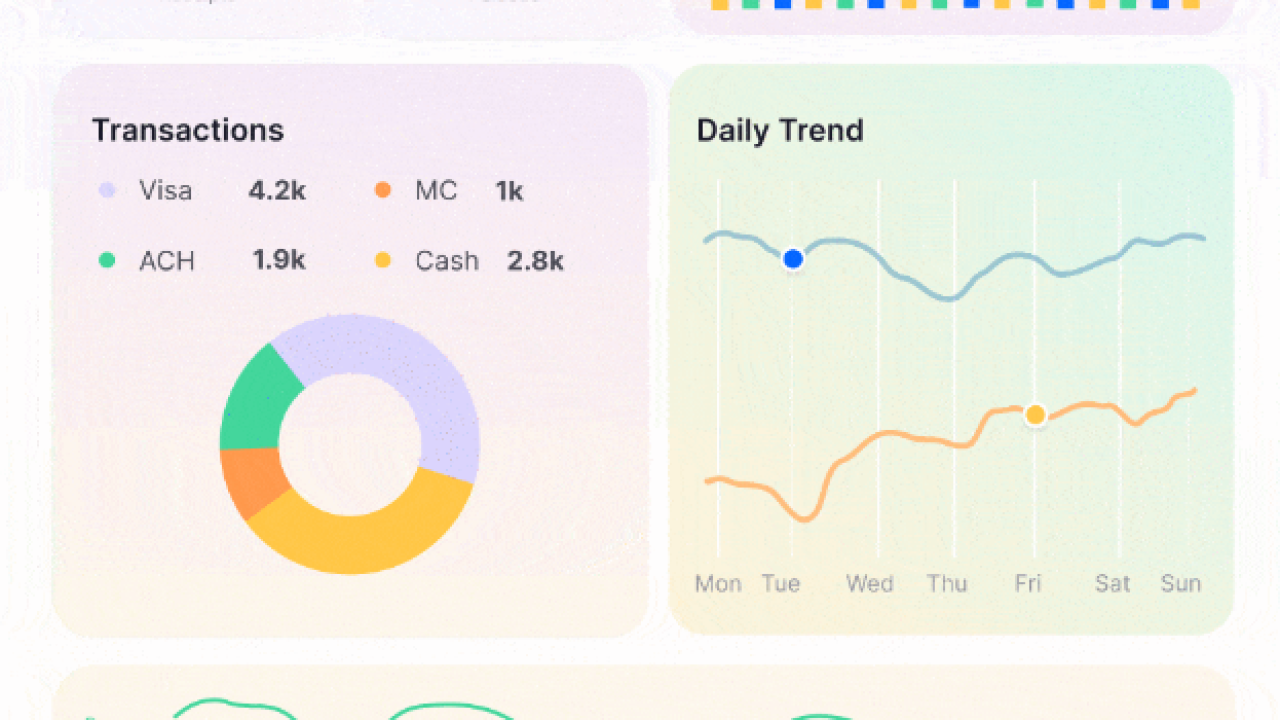

7. Uncovering Insights through Data Analysis:

Beyond the primary function of reconciling transactions, automated systems pave the way for advanced data analysis. By centralizing and organizing financial data, organizations gain insights into spending patterns, cash flow trends, and potential areas for optimization. This analytical capability contributes to informed decision-making and strategic financial planning.

8. Scalability for Growing Businesses:

As businesses evolve and grow, so do their financial complexities. An Automated Reconciliation System is designed to scale seamlessly with the organization, accommodating increased transaction volumes, additional accounts, and evolving financial structures. This scalability ensures that the system remains a reliable and efficient tool as the business expands.

Conclusion: Transforming Financial Operations for the Future:

The adoption of an Automated Reconciliation System marks a significant leap forward in the evolution of financial operations. Beyond the immediate benefits of efficiency and accuracy, these systems empower organizations to navigate the complexities of modern finance with confidence. As businesses embrace the transformative potential of automation, the Automated Reconciliation System emerges as a cornerstone in the foundation of agile, data-driven financial management.

For more details, visit us :

Treasury Management Software for Fintech

Software for Finance Reconciliation

Bank Reconciliation Software for Fintech